South East Asia Correspondent in Bangkok

Getty images

Getty imagesWhen US President Donald Trump announced his dramatic tariff on 2 April, there was no more shock than Southeast Asia, an area that has been built on the whole world visual and economic model exports.

In some countries, levy increased by 49%, killing electronics exporters in Thailand and Vietnam to kill several industries for chip manufacturers in Malaysia and clothing factories in Cambodia.

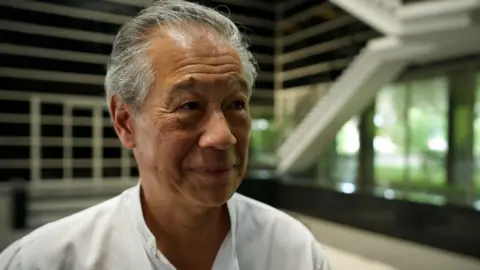

“I remember waking up in the morning. It was quite early, and saw him standing with his board standing on the lawn of the White House. I thought:” Did I see that right? 36%? How can it be? ” Richard Han says, whose father established Hana Microelectronics, one of Thailand’s largest contract manufacturers.

Thailand, who was facing 36% levy, is now a deal, like most of its neighbors, to reduce the tariff by 19%.

The dialogue went to the wire, the final form was finalized just two days before the deadline determined by Trump – 1 August. This has been a frightening process, and still has very little details what exactly has agreed.

BBC/ Lulu Luo

BBC/ Lulu LuoASEAN is known as the South East Asian Regional Block, it is exported to $ 477BN (£ 360BN) goods in the United States in 2024. Vietnam is the most exposed economy ever, its export to the US is $ 137BN, which is about 30% of its GDP.

No wonder that the Vietnamese government was out of the first block to interact with the US, and Trump cut a rate of 46% on him to make a deal to do the first so in the region.

According to the US President, The deal cuts the tariff up to 20%, While he claims that Vietnam will no longer put any tariff on any imports from the US. Apparently, the Vietnamese leadership has not said anything about the deal.

There is no details, there are no written or signed documents, and some reports suggest that Vietnam does not agree with the number of Trump. But he set the bar for other countries of the region.

Indonesia and the Philippines pursued their tariffs with deals that reduced by 19%, although neither the country depends a lot on exports to the US.

Thailand exports a lot to America. Last year he earned it more than $ 63bn, one-fifth of its total exports. Thailand should also have been the head of the queue in Washington, 36% was nominated by party trump for tariff reduction.

Getty images

Getty imagesBut Thailand is not Vietnam, one-sided communist state where important decisions can be made quickly by some leaders, with much less need to worry about businesses or public opinion.

Rather, like South Korea and Japan, whose deals came after a lot of torture despite American allies being fanatic, Thailand will also have to fight with domestic politics and public opinion. Thailand also has a weak and frightening coalition government, for a series of vested interests.

Worse, decision -making decisions that were completely unrelated to annoy the US side.

In February, it sent 40 Uygar refugees who had been trapped in Thailand in China for more than a decade, defying the warning by US State Secretary Marco Rubio. A Thai trade officer told the BBC that the US dialogues were still bringing Uygar as a complaint in tariff talks in May.

The commander of a regional army then filed a complaint against the American academic, resulting in jailed and then forced to leave Thailand. Therefore, from the front from the front, Thailand found himself behind the queue.

The other difficulty facing the Thai trade team was the one that was asking in exchange for the US tariff rate cut, especially in access to Thailand’s agricultural market, which is heavily preserved.

Food is a big business in Thailand. CP Group is the largest company in the country, one of the world’s agrarian business giants. This American demand was painful for Thailand.

“Vietnam opened the box of a pendora,” says another Thai business officer. “By offering zero percent tariffs on all American imports, they make it difficult for those of us who cannot easily open all areas in American competition.”

BBC/ Lulu Luo

BBC/ Lulu LuoThree -hour drives from Bangkok, in Nakhon Nayok, Vorvut Siripun holds 12,000 pigs – an important business in Thailand; This eat a lot of pork. He is active in the Thai Swine Raisers Association, and is advocating against the abolition of tariffs on the American Pork.

“American farmers produce a large scale from us, and their cost is low. Therefore, their pork will be lower, and domestic farmers will not be able to survive.”

Access to the agricultural market was also a sticky point in conversation with Japan, which demanded to protect its rice farmers, and remain one of the main obstacles with India.

In Thailand, it is believed that Agribes’ like CPs are also advocating against American demands to open poultry and other areas such as Poultry and Corn. After every round of tariff dialogue in Washington, there have been horrific meetings between the business team and the cabinet ministers, the BBC understands.

BBC/ Lulu Luo

BBC/ Lulu LuoBut on the other hand the manufacturer of Thailand is, who represent a much larger contribution to the GDP compared to agriculture. He needed a deal badly.

“If we receive 36% then it’s going to be terrible for us,” said SK Polymer Deputy Managing Director Suparp Suwanpimolkul before announcing the deal. The company creates a frightening array of components with rubber and synthetic materials for washing machines, fridge, air conditioners.

“I guarantee that you will find at least one of our products in your home,” he said.

SK Polymer was established in 1991 by Suparp and his two brothers. Its story is the story of modern Thailand, which originated from his father’s small family business, but riding explosive development of global trade which has been the foundation of Thailand’s economy.

They are an integral part of an complex supply chain, where their products are included in other components from many countries, so that they can make consumer, industrial or medical goods for exports. About 20% of the company’s income comes from the US, but the number is very high when products include its components. Trump Tariff has thrown a spanner in the works.

“We have small margins,” said Suparp. He said that they can still manage with tariffs up to 20% or 25% by cutting costs. When he spoke to the BBC, before announcing the deal, he said that uncertainty was the biggest challenge: “Please – for our government, just get a deal, so we can plan our business.”

BBC/ Lulu Luo

BBC/ Lulu LuoA large industry in Thailand is also delicious for 20% levy for electronics manufacturers.

Hana Microelectronics CEO Richard Han says, “If all of us in this field finished with about 20%, our buyers will not look for alternative suppliers – this will just be a tax, such as VAT, for American consumers,” Hana Microelectronics CEO Richard Han says. The company forms the original component that goes into everything in our digital life: printed circuit board, integrated circuit, RFID tag for pricing.

Mr. Han says that about 12% of his products go to the US only, but the Ratio -like ratio that goes indirectly, as part of other manufactured objects, is very high. But this is not just tariff number that concerns him.

Their concern is trans-appearance, American allegations that China is avoiding tariffs by rooting its production through Southeast Asia. Already Vietnam, according to President Trump, will pay 40% – the new tariff will double the rate – to translate American judges on goods.

Both Thailand and Vietnam saw a significant increase in foreign investment after the tariffs were imposed on China during the first trump period, and their exports to the US also increased. Some of them used to carry forward production of Chinese companies; Some were products using very much Chinese -made components. And they are not just from China.

Another electronics manufacturer, in SVI, the robot brought the assembly line up and down and brought hundreds of small components to collect circuit boards in machines, priced at hundreds of thousands of dollars. A quick eye on the label revealed that the components came from Malaysia, Philippines, Taiwan and China.

SVI safety cameras, Bispoke amplifiers, medical equipment, whichever specifications are their customers, who are mainly in Scandinavia, they want. The important manufacturing sector of Thailand is part of a highly complex global supply chain that is almost impossible to rearrange the US President’s demands.

Under the WTO regulations, a product is considered local if the value of at least 40% of its value is added to the local manufacturing process, or if it has been “quite changed” in a new product, the way an iPhone becomes different, it is assembled once.

BBC/ Lulu Luo

BBC/ Lulu LuoThe Trump administration does not pay any attention to the rules of the WTO, and it is not clear what will be counted as a trans-appearance, but Mr. Han fears that it can prove to be a major problem for Thai companies than the standard tariff rate if the US emphasizes more local components, or less than China.

“South East Asia depends a lot on China,” they explain. “China, so far, is the largest supply chain for electronics and many other industries, and they are the cheapest.

“We can buy materials from another part of the world. It will be much more expensive. But it would be almost impossible to get too much threshold for Thailand or Vietnam or Philippines or Malaysia, says 50–60%, it is built within that country.

At present, very few of these details have been revealed. Despite President Trump claiming that he has received zero percent tariffs for American goods coming to the Philippines and Indonesia, the two countries have said that this is not correct, and this still needs to negotiate.

For the Thai government, it started so late, and struggled to meet American demands, just getting a deal would be a relief.

They will worry about how to work later the deal, as the details are worked, which usually takes years. And in this, they are far from alone – rich and developing economies are equally hitting the foot to maintain Trump’s mercurial tariff policy.

“It has to be stopped at some point. Surely to stop it?” Mr. Han says. “The problem is, we don’t know what the rules of the game are going to be, so we are all milling around, just waiting to find out how to play the new game.”